Topic: Increasing of living standards depends on long-run economic growth and price stability. Critically examine the challenges of achieving this objective in an open economy with business cycles using case study of a country from Europe and North America.

Introduction:

“The world has also learned that economic growth, by itself, cannot close the gap between rich and poor” (Dalai Lama XIV)

The high rate of economic growth is an impressive achievement of the 21st century. The majority of western countries, developed economically on a high level, have achieved success by increasing economic output. But, has such an impressive increase actually improved living standards? Logically approaching the topic, economic growth should be equal to better living standards, but it is a more confusing process. Many factors affect our standards of living, usually, they are completely unrelated to the economic growth or to the price stability. Considering the collaboration between economic development or price stability and the improvement of living standards in the context of long-term growth, we can conclude that it is difficult to achieve the purpose. In this essay, I will briefly introduce the main macroeconomic concepts for this topic, then I will critically analyse the issue using the opinions of professionals, business cycles and relevant economic data.

Main body

It is not easy to assert an analytical definition of living standards, which will be the most correct from the point of view of logic. In the dictionary of English, we can find three definitions of what the standard of living is. One of them announces that the living standard is the level of comfort of people (in different social classes or countries) and the quantity and quality of products and services they can buy at their income (Cambridge Dictionary, 2019). The standard of living, in economic terms, is the sum of the well-being of man and his household and the society in which he lives. It is determined by many factors: income, GDP, economic growth, political stability, freedom, climate and environment, security and access to education or health care. It is closely related to the quality of life. However, there are many opinions on the proper conceptualization of welfare (Zapf, 2002).

Get Help With Your Essay

If you need assistance with writing your essay, our professional essay writing service is here to help!

In the simplest way to define economic growth, it is the increasing ability in the production of goods and services compared in time. If in a given year more goods and services are sold in the whole economy than in the previous year, there is economic growth. The growth is traditionally measured using GDP, sometimes with alternative indicators. When we will able to earn more money, then the growth will be determined by our work. If at the same time as our earnings increased, the prices of the goods we buy had risen, we only had to deal with a nominal increase. In such a case, the right indicator of growth will be real GDP, which takes into account the effect of inflation. Economic growth refers only to quantitative changes, assuming that the underlying macro-economic values are characterized by a long-term trend (Tokarski, 2008).

The term price stability means that prices do not rise or fall on average, but remain stable for a long time. Inflation and deflation are important factors of creating price stability. These are important economic phenomena that have unfavourable effects on the economy. In principle, inflation is defined as a general increase in the price of goods and services over a longer period of time, leading to a decline in the value of money and thus in purchasing power. Deflation is the opposite of inflation. If, for instance, EUR 100 today is enough to buy the same basket of goods and two years ago it was the same amount of money for the same basket, there is absolute price stability.

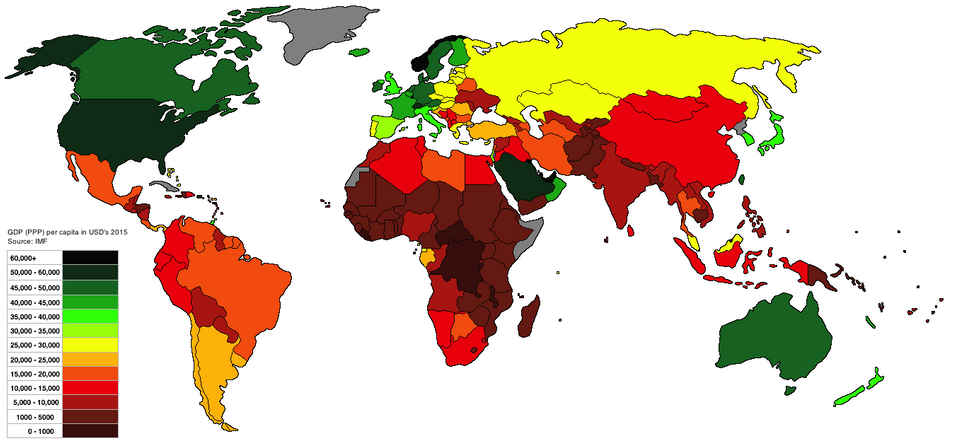

The basic measurement of the living standards is the gross domestic product, which describes the aggregated value of final goods and services produced in the country within a period of time (usually within a year). The most commonly used version to measure living standards is real GDP, which takes inflation into account (Krugman &Wells, 2012).

However, GDP, as a tool for measuring our well-being, has many drawbacks. There is a lot of things it doesn’t take into account, including; unpaid work (value of housework, child care, community services), distribution of wealth (the situation in which a larger part of real GDP profits will go to a relatively small group of the population), changes in the quality of life

(clean air, access to water, leisure time, increasing traffic congestion or safety), changes in the quality of goods. By definition, it is impossible to include in GDP anything that does not have a fixed price like externalities of production (environmental pollution) or social discomfort caused by social inequalities.

Source: GDP(PPP) Per Capita Around The World IMF Annual Report 2015

Paradoxically GDP takes into account the production of anti-goods (stimulants), compensation for losses caused by natural disasters or expenditure on armaments. In some situations, GDP is a sensible indicator, as its growth usually means a good condition of the economy, an increase in industrial production, an inflow of foreign investments and an increase in exports. However, in terms of living standards, the GDP indicator is not sufficiently reliable. There are also other standards of living yardsticks besides real GDP per capita;

-GPI (The Genuine Progress Indicator) developed in 1995. GPI covers crime and family breakdowns, household and volunteer work, income distribution and pollution

– HDI (The Human Development Index) is composed of three factors; life expectancy, education and level of GDP per capita that adjusts for price differences between countries.

-Index of Social Health consists of 16 indicators; for instance child poverty, unemployment, violent crime, teenage births or youth suicide.

The relationship between inflation and economic growth

Economic growth is the basis for an increase in the standard of living of citizens, an increase in investment and, therefore, better development of the budgetary sphere. Speaking of economic growth, we should understand a situation in which the effect of society’s economy improves from year to year by constantly increasing a country’s ability to produce goods and services desired by people. In other words, economic growth is a quantitative increase in basic values and, above all, national income per capita (Tokarski, 2008). Therefore, we can conclude that the amount of economic growth is influenced by the productive capacity of a given economy, i.e. the type of production technology and personal factors of production (the level of qualifications of work, the level of unemployment, etc.). When analysing the relationship between inflation and economic growth, I accept the working definition of inflation as price volatility, measured by the deviation of actual prices from the CPI adopted by the central bank. Such a concept of inflation is convenient for even the most complex theoretical and empirical considerations. For instance, the 2,5% level adopted in Poland as a direct inflation target means that the Polish monetary policies announce both that it will fight inflation above this level and deflation, as the policy would like to stabilise prices, in the longest possible period of time, in order to reach 2,5 % target. Econometric models are used to calculate the impact of inflation on economic growth. For example, P. Baranowski and

Find Out How UKEssays.com Can Help You!

Our academic experts are ready and waiting to assist with any writing project you may have. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs.

View our academic writing services

M. Raczko calculated for the EU countries in the years 1971-2000 that the inflation growth by 10 points in the following period ceteris paribus reduced the GDP per capita growth rate by 1.41 points (Baranowski, 2004, p.70-72). The presented data show that the inflation rate has a delayed impact on economic growth. The obtained results allow us to conclude that there is a very strong correlation between the inflation rate and the economic growth rate, measured by the GDP growth rate.

Price stability is effective in achieving economic growth.

(On the example of the USA)

The FED president Ben Barnanke in 2013 believed that the US would not be threatened in any way by inflation. The FED strongly estimated that in 2013 inflation in the US will amount to 1.3%. The annual growth rate on the Consumer Price Index (CPI) in March 2013 was 1.5% compared to 2 % in February and 2.7% in March 2012. In addition, the dynamics of the base CPI (CPI excluding food and energy prices) decreased compared to the month before. In annual terms, the growth rate dropped to 1.9% from 2% in February and 2.3% in March 2012 (Shostak, 2013). According to Bernanke, the main factor that influences the favourable results is a stable price level, reflected in the consumer price index. In line with this reasoning, a stable price level does not obscure the relative price development of goods and services, but clearly conveys to companies the market signals that are associated with these changes. As a result, a stable price level allows for more efficient use of scarce resources in the economy, resulting in healthier economic indicators. Suppose that there has been a relative increase in demand for potatoes in relation to demand for tomatoes. It is maintained that such a relative increase will be reflected in an increase in potato prices in relation to tomato prices. In the free market, businesses draw attention to the wishes of consumers, which can be seen in the changes in relative prices of goods and services. Acting contrary to the wishes of consumers leads to losses. In this case, by showing an interest in relative price changes, companies are likely to increase potato production. Following this trail, if the price level is not stable, the picture of relative price changes is blurred and companies cannot assess the relative changes in demand for goods and services and make the right decisions. This process leads to inappropriate use of resources and to a weakening of the key economic indicators. In short, volatile changes in price level obscure the picture of changes in relative prices of good and services. Using various quantitative methods, the FED’s economists agreed that decision-makers should aim to keep price inflation at 2%. Any significant deviation from this level means a deviation from the path of stable prices, which is supposed to guarantee the development of stable prices.

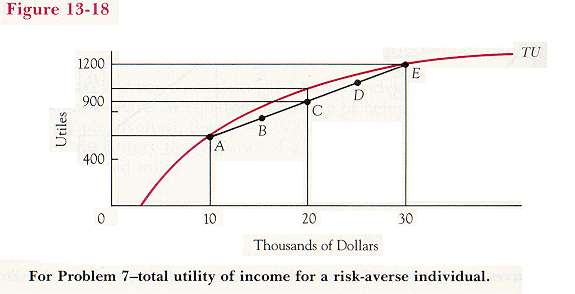

Diminishing marginal utility of income

Economic growth cause increasing rates of our income, there is no doubt. But if we have already two cars, does it really improve our living standards if we decide to buy another car? For a long time, the theory of economics has not been able to answer many questions like why water, without which people can not live, is so cheap? This paradox of values was solved in 1870, known as the marginalist revolution. On the chart below we can see that the marginal utility is a decreasing function of the quantity of a given good. When we increase the number of goods consumed, the total benefit increases. However, the increase is less than proportionate, as the marginal utility of the successive units consumed decreases. Marginal utility decreases as income increases (Layard, 2008). This means that when we reach the level of satisfaction of our needs, each subsequent increase in income and thus the ability to buy better value for money will not improve our standard of living. Going back to the first example with a car, buying another car will not improve our standard of living because we are not able to drive three of them at once.

Source: Friedman, D. (2011)“ Price theory” http://www.daviddfriedman.com/Academic/Price_Theory/PThy_Chapter_1/PThy_CHAP_1.html

Inflation of living costs

At the beginning of the 80s, the annual income of 100,000 dollars in the US was the level of success. It allowed to buy a flat, a car, provide education on a high level or holidays for the whole family. Currently, only 20% of Americans exceed the 6-digit level of annual income. Income of 100,000 dollars seems to be high. Unfortunately, the increasing costs of food, energy, tuition fees and the increasing expectations of the middle class mean that the income that 20 years ago provided luxury, now covers the basic costs of living. In comparison, over the last few years, the costs of living in Poland has increased on average by 60% (running water, electricity, fuel, food). Despite the fact that higher education is in Poland free of charge, the completion of studies does not guarantee a job anymore. There are more students than generated jobs. Economic data indicate growth of both countries. Both in the USA and in Poland we have technological development, innovation in key economic areas, development in infrastructure, agriculture, armaments, construction, education and others. Despite this, the standard of living does not change significantly. With the presence of modernization and economic growth, citizen’s incomes have risen, but unfortunately, also the prices of goods and services have risen, leaving us at standstill.

Conclusion

The concept of prosperity has nowadays been extended by the broadly understood quality of life. The quality of life depends on the possibility and level of satisfaction of its various needs, not only of economic nature but also of social character. Measuring the standard of living solely on the basis of the GDP, which is the indicator of economic growth, is not very reliable.

Bibliography:

- Weil, J. (2016/17) “The essential constituent of Modern Living Standards” Academic journal, Vol. 42, Boston, Ploughshares, pp.149-159

- Mester, L. J. (2015) Long-run economic growth. New York: New York University Stern Center for Global Economy and Business, pp.4-8

- Zapf, W. (2002) Euro Module: Towards a European Welfare Survey. Berlin: Social Science Research Center

- Shearer, R. A. and Arbor, A. (1961) “The concept of economic growth” Kyklos: Internetional Review for Social Sciences 14(4), Michigan, pp.498-530

- Friedman, M. and Savage, J. (1948) “The utility Analyse of Choices Involving Risk” Journal of Political Economy 56(4), pp.280-304

- Tokarski, T. (2008) Economies of scale and economic growth, Cracow, Jagiellonian University, pp.12-23

- Gerdemeser,D. (2005) “Why is price stability important?”, Frankfurt, European Central Bank Report, pp.22-30

- Lagarde, Ch. (2018) “Building Shared Future”, IMF Annual Report, Washington, pp.65-70

- Baranowski,P. and Raczko,M. (2004) Economic growth and inflation in the European Union Countries. GUS: Statistical Informations, Warsaw, pp.70-80

- Shostak, F, (2013) “Stabile prices and volatile markets”, MISESA Institute Report, pp.46-54

- Leyard, R. Mayraz, G. and Nidell,S. (2008) The Marginal utility of Income, Journal of Public Economies, London: London School of Economies, pp.2-8

- Krugman, P.R. and Wells, R. (2012) Economics 3rd ed, Macmillan Higher Education, Worth publishers, pp.477-499

- Cambridge University Press. C2018. Cambridge Dictionary of English. [online]. [20 January 2019]. Available from: https://dictionary.cambridge.org/dictionary/english/standard-of-living

- Gremi Media SA, K.M. 2014. How to measure welfare? 08 MAY. Rzeczpospolita. [Online]. [18 January 2019]. Available from: https://www.rp.pl/artykul/1107887-Jak-mierzyc-dobrobyt.html

Cite This Work

To export a reference to this article please select a referencing style below: